During any other month, seeing this group of Kent State nursing students using models of bones to study for their anatomy class wouldn't evoke any reaction. But, during "spooky season," it hits different.These students, taking advantage of the large tables and excellent atmosphere for study in the University Library, are all first-year students in Kent State's College of Nursing. Clockwise, from the top of the photo, they are: Taylor Wright, from Painesville, Ohio; Sam Boehnlein from Avon, Ohio; Addyson Kristofic from Pittsburgh; and Alona Kaminski from Talllmadge, Ohio.  ...

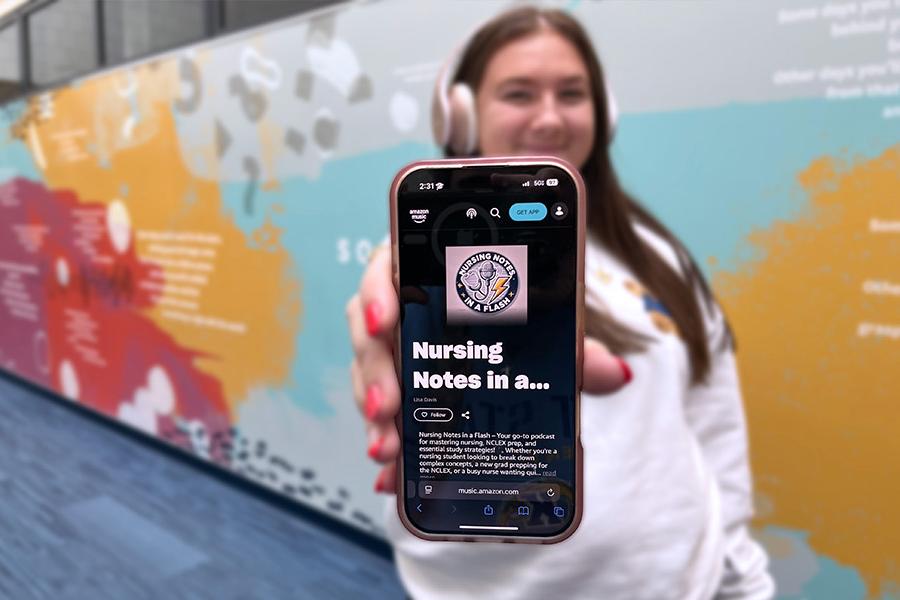

When Lisa Davis, MSN, RN, a seasoned nurse and Kent State University College of Nursing lecturer, woke up in the middle of the night with the perfect name for a podcast, she didn't hesitate—she texted it to her husband at 3:30 a.m. and went right back to sleep. That spark of inspiration became Nursing Notes in a Flash, a podcast she launched in February 2025 to deliver quick, high-yield clinical insights in a format that's approachable, supportive and grounded in real-world nursing. A longtime podcast enthusiast and pharmacology lecturer, Davis saw an opportunity to make complex content ...

The Kent State University School of Fashion has a strong legacy of participation in the prestigious Supima Design Competition, which highlights some of the most promising emerging designers in the U.S. The 2025 Supima Design Competition took place on November 5, 2025. The competition features collections from five finalists, each representing a leading U.S. fashion school. These top fashion schools selected one exceptional graduate to represent their institution. The finalists are tasked with creating a womenswear capsule collection using premium SUPIMA cotton fabrics, culminating in a pr...

Ohio’s investment in wetland restoration continues to show promise, according to new findings led by Lauren Kinsman-Costello, Ph.D. associate professor of biology at Kent State University. The results, published in the 2024 H2Ohio Wetland Monitoring Program Annual Report, offer valuable insights into how wetland design and management influence nutrient retention — information that is already helping guide statewide strategies to improve water quality and reduce harmful algal blooms (HABs) in Lake Erie and beyond.Since 2021, scientists from Kent State and five other universities — working...