Continuing on from Undergrad?

Seamlessly transition from your undergraduate degree to a master’s program that deepens your expertise and accelerates your future. Stay part of the Kent State community you love while earning your next degree.

Ready to Advance Your Career?

Earn the credentials, confidence, and connections to lead in your field—on your schedule, without putting life on hold. Kent State’s flexible graduate programs are designed for working professionals ready to take the next step.

Ready for a Career Change?

Take what you’ve learned and turn it into something new with programs designed to help you pivot, grow, and start your next chapter.

Join Republic Airways representatives in the Kent State Airport lobby to learn about exciting career opportunities in aviation. Aidan McSteen, Republic Airways Ambassador and current Kent State flight instructor, will be available along with a company pilot to answer questions about internships, full-time roles, and pathways to becoming a professional pilot.

Date & Time: Tuesday, November 18, 10:00 AM – 12:00 PM

Location: Kent State Airport Lobby

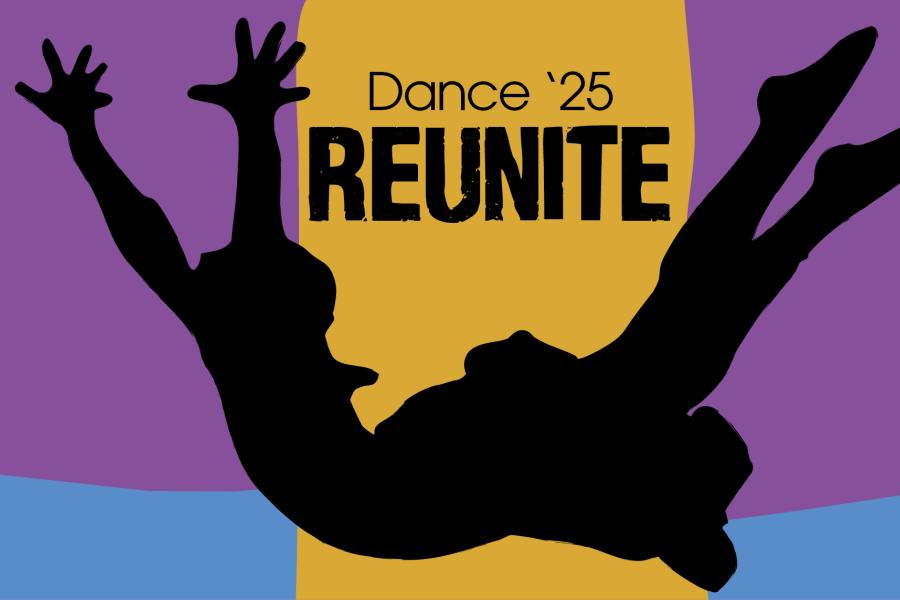

Kent State University’s School of Theatre and Dance continues its 2025-2026 season with Dance '25-ReUnite, running November 21 through 23 in E. Turner Stump Theatre, located in the Center for Performing Arts.ReUnite, is a call to action. At a time when people are polarized by their political associations, this title attempts to bring us all together. Four faculty have worked to realize five unique dances that take the audience on a shared journey of music, drama and movement. When the world seems fragmented, the arts provide us with healing, joy, perspective and an appreciation of life.The art...